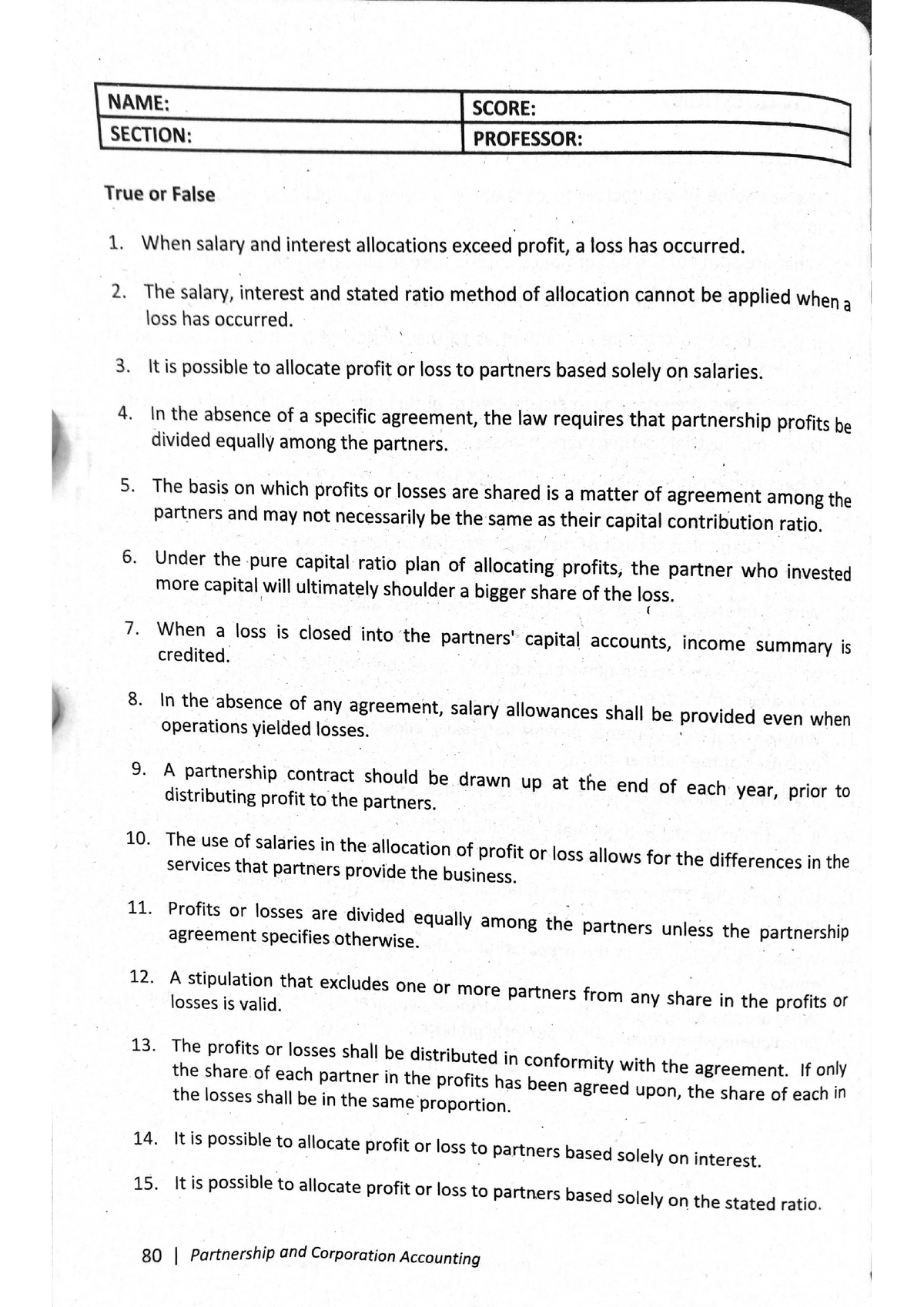

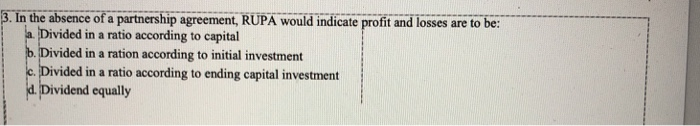

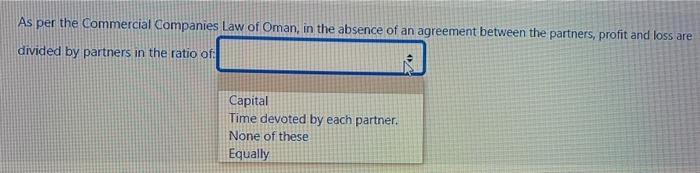

Solution Question Read more In the absence of partnership deed interest on loan will be (MP 11,15) (a) 10% pa (b) 6% (c) 6% pa (d) 10% Answer (b) 6% Question 3 In the absence of partnership deed profit is divided in (a) Capital ratio (b) Equally (c) Liability ratio (d) None of the above Answer (b) Equally Question 4 Liabilities of partners is (a) Limited th Profit share All partnerships with a written agreement can agree to share profits on any basis they choose, and vary them from year to year as they decide The deed should be explicit as to the mechanism of calculation eg "as the partners shall from time to

Pin On Ingles Infantil

In absence of partnership deed how is profit divided

In absence of partnership deed how is profit divided-👍 Correct answer to the question In the absence of deed the profits of a firm are divided among the partners (a) in the ratio of capital (b) equally (c) in the ratio of time devoted for the firm's business (d) according to the man eanswersin In absence of partnership deed how is profit divided?

Covid Economics Centre For Economic Policy Research

In the absence of partnership deed the profits of a firm are divided among the partners a In the ratio of capital b Equity c In the ratio of time devoted for the firm's business d According to the managerial abilities of the partners Profit will be distributed in Equal ratio When there is no partnership deed or partnership deed is prepared but it is silent on profit sharing ratio, in such a case rules of Partnership Act, 1932 will be applicable According to which, profits or losses will be shared by the partners equally irrespective of their capitalsIn the absence of an agreement profit and loss are divided by partners in the ratio of

Janani, Kamali and Lakshmi are partners in a firm sharing profits and losses equally As per the terms of the partnership deed, asked in Accounts of Partnership FirmsFundamentals by AbhijeetKumar ( 502k points)(d) Any number of partners 5 In the absence of an agreement profit and loss are divided by partners in the ratio of (a) Capital (b) Equally (c) Timedevotedbyeachpartners (d) None of these 6 In the absence of an agreement, Interest on loan advanced by the partner to the firm is allowed at the rate of (a) 6% (b) 5%👍 Correct answer to the question In the absence of partnership deed, profits are divided by partners in the ratio of a capital b time devoted c equal d none of these eanswersin

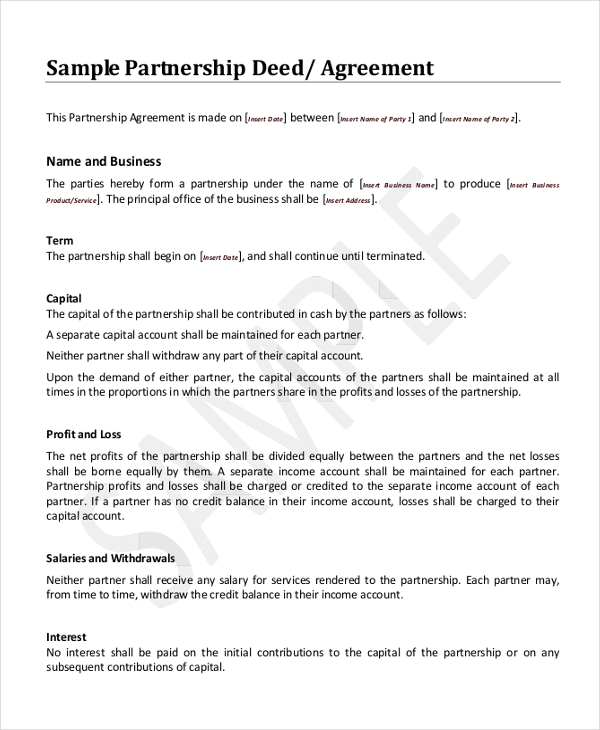

Free NCERT Solutions for Class 12 Maths, NCERT Solutions for Class 12 Science, NCERT Solutions for Class 12 Social Science, NCERT Solutions for Class 12 English, NCERT Solutions for Class 12 Hindi NCERT Books chapterwise Solutions (Text & Videos) are accurate, easytounderstand and most helpful in Homework & Exam PreparationsProfitSharing Agreement A profitsharing agreement is a written contract, signed by all partners, that specifies how profits and losses will be allocated to the partners Generally, profitsharing is a part of the partnership agreement, which will also specify the rights and responsibilities of the partners in managing the business Hence if a firm is not having any written agreement or a partnership deed or if partnership deed is there but it is silent on certain issues the following provisions of the Indian Partnership Act 1932 will be applicable 1 Profit sharing Ratio Profits and losses would be shared equally among partners 2

Partnership

How Does The Profit Sharing Work Among Partners In A Pvt Ltd Company Quora

(b) Equally According to partnership act 1932, in the absence of any partnership deed, profits of the firm are divided among the partners equally(ii) Divisible profits should be divided equally (iii) Interest should be allowed on capital and loan at 5% pa Solution Note In the absence of agreement between the partners, the Partnership Act 1932 will apply accordingly, 1 No interest is provided on partners Capital in the absence of Partnership Deed 2(c) In the ratio of time devoted for the firm's business (d) According to the managerial abilities of the partners (b) Equally According to partnership act 1932, in the absence of any partnership deed, profits of the firm are divided among the partners

Partnership Rules Faqs Findlaw

Partnerships Boundless Business

Ram, Rahim and Roja are partners sharing profit and loss in the ratio of 3 2 1 As per partnership deed, Roja's minimum profit will be Rs 10,000 pa The profit for the half year ending on 31st March, 17 was Rs 24,000 Pass necessary Journal Entries for the distribution of the profit and prepare Profit and Loss Appropriation Account Below is a summary of some of the more important provisions implied by the Partnership Act Profits in the absence of a specific provision to the contrary, section 24 of the Partnership Act provides that profits and losses are to be divided equallyIn the absence of Partnership Deed, what are the rules relation to (a) Salaries of partners (b) Interest on partners' capitals (c) Interest on partners' loan (d) Division of profit (e) Interest on partners' drawings Answer 1 (A) Salaries of Partners – No Salary Is Payable To Any Partner

Pin On Ingles Infantil

Ts Grewal Solutions For Class 12 Accountancy Accounting For Partnership Firms Fundamentals Accountancy

Hence if a firm is not having any written agreement or a partnership deed or if partnership deed is there but it is silent on certain issues the following provisions of the Indian Partnership Act 1932 will be applicable 1 Profit sharing Ratio Profits and losses would be shared equally among partners 2Distribution of Profit among Partners In accordance with the provisions of the partnership deed, the profits and losses made by the firm are distributed among the partners However, sharing of profit and losses is equal among the partners, if the partnership deed is silentAccounting Rules in the absence of Partnership Deed #PartnershipAccounting #Class12 #BCom #CalcuttaUniversityPartnership AccountingISC12CBSC12WBC

Chapter 04 Sm Yep Accountancy Bsa Ue Studocu

Basic Concept Sole Proprietorship Business Forms Of Business Partnership Joint Hindu Family Business Cooperative Society Company Ppt Download

Profit is then appropriated as per the terms of the Partnership Deed Divisible Profit means profit after crediting Interest on Drawings (if any) to Profit and Loss Appropriation Account and debiting salary to partners, interest on capital, etc It is divided among the partners in their profit sharing ratio Following questions will make it clearRosy would have convinced Jaspal for sharing the profit equally as the rule, in the absence of partnership deed is to share the profit equally as per the Indian partnership act, 1932 Point of KnowledgeIn the absence of Partnership deed Profit In the absence of partnership deed the profit and loss arising from the partnership business is shared equally by the partners It is not shared according to capital contributed by the partners;

Class 12 Accounts Fundamental Of Accounts Notes

1

By profit sharing ratio in a partnership firm, we mean the ratio in which the profits and losses of the firm are to be distributed amongst the partners The basis for arriving at the ratio is the agreement between the partners If there is a partnership deed, the ratio should be ascertained from the provisions in the partnership deedIt usually comprises the attributes about all the characteristics influencing the association between the partners counting the aim of trade, the contribution of capital by each partner, the ratio in which the gains and losses will be divided by the partners and privilege and entitlement of partners to interest on loan, interest on capital, etcIt is only done if there is agreement between the partners in the partnership deed

Pin By Zigya On 12th Board Papers Equality Previous Year Short Answers

Remuneration To Partners In Partnership Firm Under 40 B

Sonisonusoni306 sonisonusoni306 Accountancy Secondary School answered In absence of partnership deed how is profit divided?In the absence of partnership deed the profits of a firm are divided among the partners (a) In the ratio of capital (b) Equally (c) In the ratio of time devoted for the firm's business (d) According to the managerial abilities of the partners(i) Sharing of profits and losses If the partnership deed is silent on sharing of profit or losses among the partners of a firm, then according to the Partnership Act of 1932, profits and losses are to be shared equally by all the partners of the firm (ii) Interest on partner's capital If the partnership deed is silent on interest on partner's capital, then according to the Partnership

Avoid Partnerships At Will Bma Law

Day 5 Class 12th Commerce Rules Applicable In The Absence Of Partnership Deed Youtube

Answer Charu is correct as in the absence of partnership agreement, profits and losses are divided equally among partners Question A and B are partners in a firm without a partnership deed A is an active partner and claims a salary of Rs 18,000 per month State with reason whether the claim is valid or not1 Division by Responsibility One way to share profit and losses in the absence of a limited partnership agreement is to divide them by the responsibility carried out by each memberIn the absence of a Partnership Deed, or if the Partnership Deed is silent on a certain point, the following provisions of partnership Act, 1932 will be applicable Profit and losses are to be shared equally irrespective of their capital contribution No interest on capital shall be

Aqa Gcse Business Studies Study Guide And Workbook Name Pdf Free Download

Important Questions For Cbse Class 12 Accountancy Profit And Loss Appropriation Account

2 See answers Advertisement Which ratio profit and loss of partners is divided in the absence of partnership deed?In the absence of partnership deed,how are the following matters resolved (a)Salaries of partners (b)Interest on partner's capitals (c)Interest on partner's loan (d)Division on loan by partners (e)Division of profit (f)Interest on partner's drawing (g)Interest on loan to partners?

Partnership Accounts

Dk Goel Solutions Class 12 Accountancy Chapter 2 Accounting For Partnership Firms Fundamentals

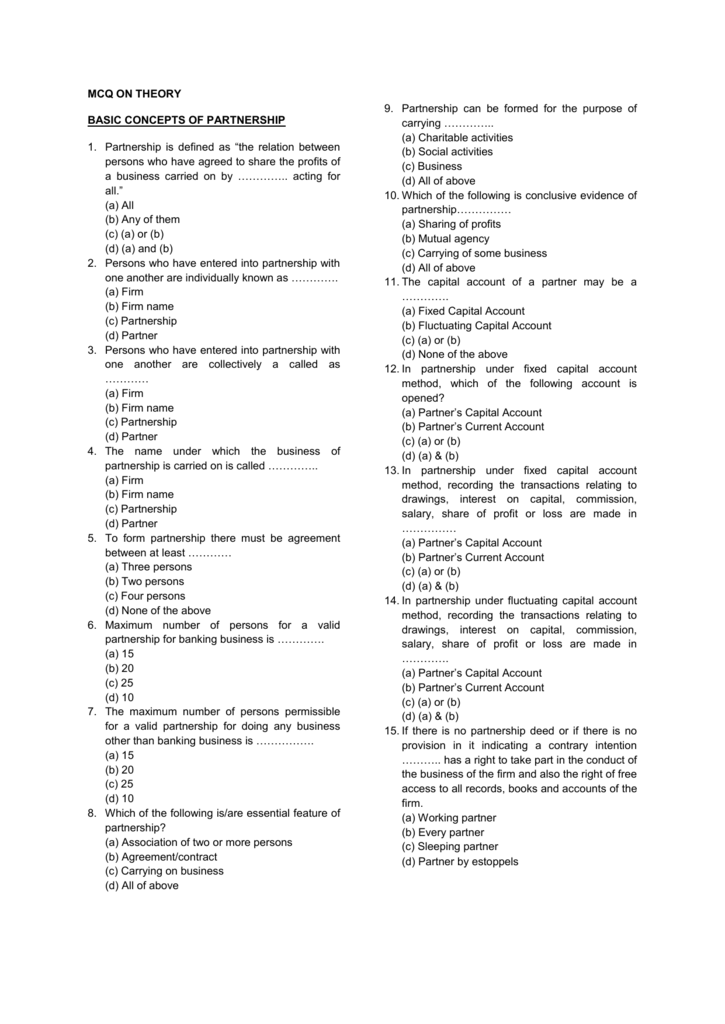

Question In the absence of Partnership Deed, the profits of a firm are divided among the partners (a) In the ratio of Capital (b) Equally (c) In the ratio of time devoted for the firm's business (d) According to the managerial abilities of the partners Accounting for Partnership Basic Concepts Class 12 MCQs Questions with Answers Question 1 Features of a partnership firm are (a) Two or more persons (b) Sharing profit and losses in the agreed ratio (c) Business carried on by all or any of them acting for all (d) All of the above Answer Answer (d) All of the aboveBut there are other ways profit and loss can be shared between partners in the absence of a limited partnership agreement They include;

2

2

Question A partnership firm earned divisible profit of Rs 5,00,000, interest on capital is to be provided to partner is Rs 3,00,000, interest on loan taken from partner is Rs 50,000 and profit sharing ratio of partners is 53 sequence the following in correct way (a) Distribute profits between partnersIn the absence of partnership deed, profits of a firm are distributed equally among all the partners Profit after Interest on A's loan = 15,000 − 240 = Rs 14,760 Pofit of A and B=14,760×1/2=7380 Question 6 Harshad and Dhiman are in partnership since 1st April, No partnership agreement was made But, in the absence of agreement, the following provisions of the Indian Partnership Act, 1932 shall apply for accounting purposes 1 Interest on Capital No interest is allowed on Capitals of the Partners If as per the partnership deed, interest is allowed, it will be paid only when there is profit If loss, no interest will be paid 2

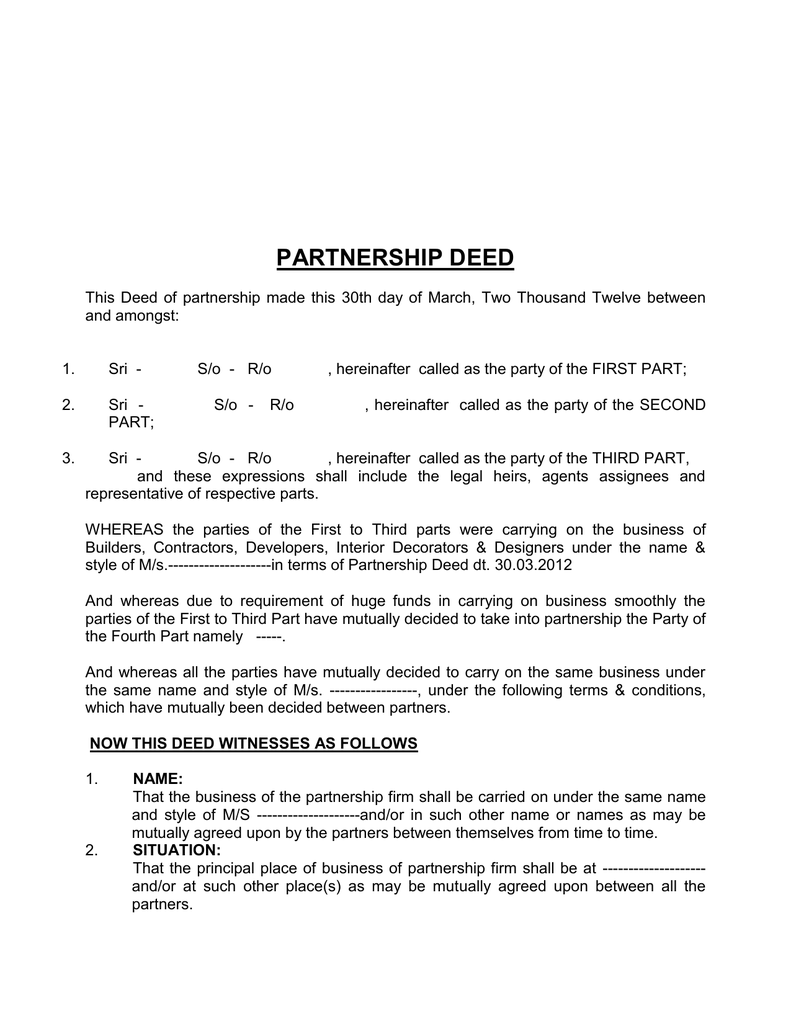

Partnership Deed Corporate Experts

Partnership Deed By Dhanya V L

In the absence of partnership deed the profits of a firm are divided among the partners (a) In the ratio of capital (b) Equally (c) In the ratio of time devoted for the firm's business (d) According to the managerial abilities of the partnersThe Indian Partnership Act, 1932 defines partnership as "the relation between persons who have agreed to share the profits of a business carried on by all or any of them acting for all" Based on this definition, the essential features of partnership are as follows 1Answer (i) Sharing of Profit and Losses In the absence of partnership deed profit the sharing ratio among the pad maw will be equal (ii) Interest on Partner's Capital In the absence of panama peru interest on partners capital will not be given

Hots Accountancy Class 12 Chapter 2 Accounting For Partnership Basic Concepts

/GettyImages-1152013583-a5bad8090c064339bf7880b7c9012379.jpg)

Which Terms Should Be Included In A Partnership Agreement

TS Grewal Solutions for Class 12 Accountancy – Accounting for Partnership Firms Fundamentals (Volume I) Question 1 In the absence of Partnership Deed, what are the rules relating to a Salaries of partners, b Interest on partner's capitals, c Interest on partner's loan, d Division of profit, and e Interest on partners' drawings?How do you Treat in the absence of partnership Deedsharing profit, interest on drawing, capital, salary to partnerand loan from partner in explanation in In case of absence of a partnership deed the profit will be shared among the partners equally According to partnership act 1932, in the absence of any partnership deed, profits of the firm are divided among the partners equally Profit will be divided equally among the partners

What Is A Partnership Agreement Insights Alston Asquith

In Which Ratio Profit And Loss Of Partners Is Divided In The Absence Of Partnership Deed Brainly In

1

A B C Are Partners In A Firm They Have No Partnership Agreement For Their Guidance At The End Of The First Of The Commencement Of The Firm Sarthaks Econnect

Distribution Of Profit In A Partnership Explanation Examples Finance Strategists

Applied Rules In The Absence Of Partnership Deed Quick Learning Youtube

Ts Grewal Accountancy Class 12 Solutions Chapter 1 Accounting For Partnership Firms Fundamentals Ncert Solutions

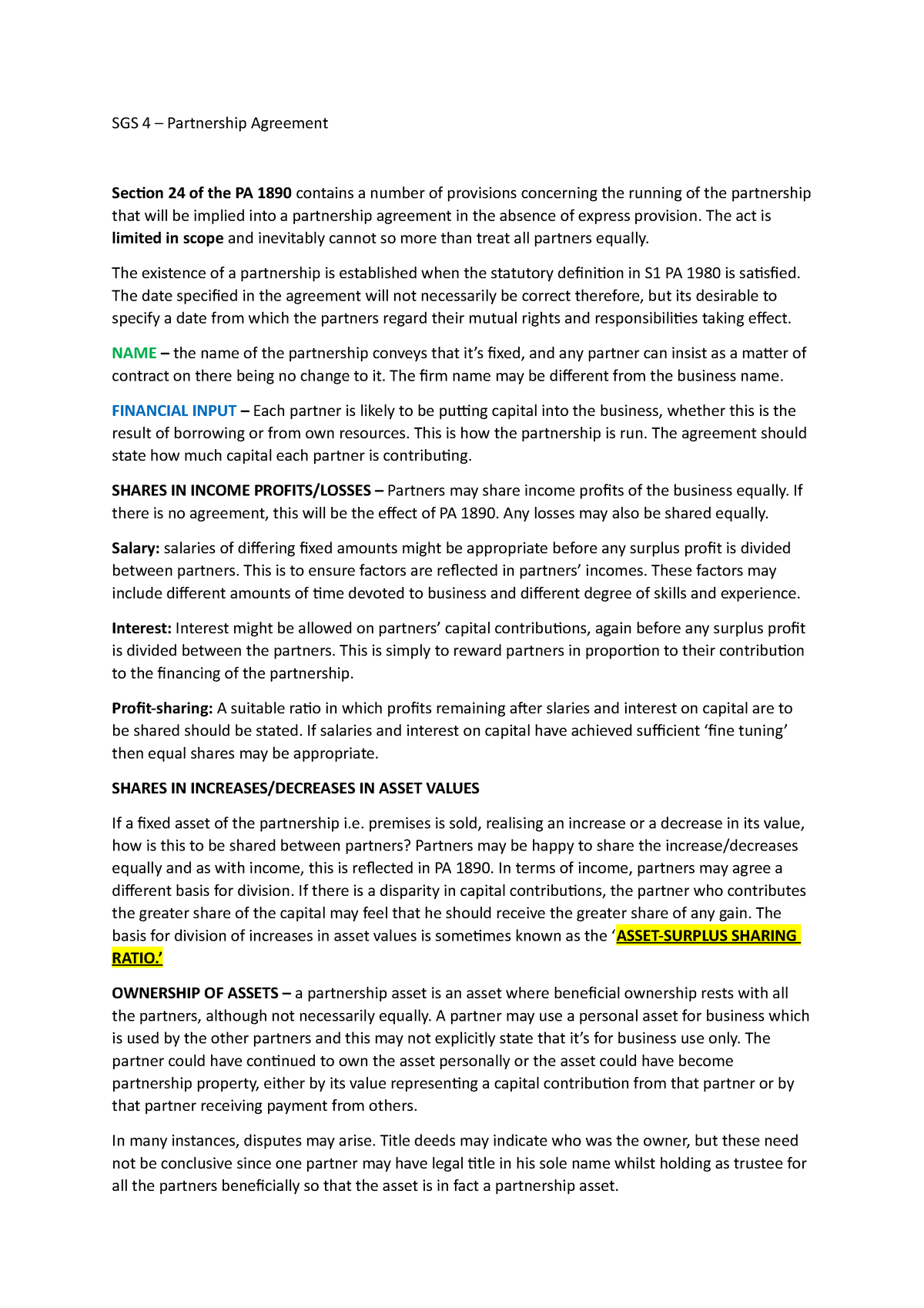

Sgs 4 Partnership Agreements Business Law Lpc7302 u Studocu

What Is Partnership Definition Characteristics And Types Business Jargons

Partnership Deed Contents Features Benefits All You Must Know

What Happens To Property Owned Jointly By The Deceased And Someone Else Low Incomes Tax Reform Group

My Word Is My Bond But Will It Hold Without A Written Agreement Harrison Clark Rickerbys

Partnership Definition Features Advantages Limitations

The Csg Team Csec Pob Study Notes Forms Of Business Facebook

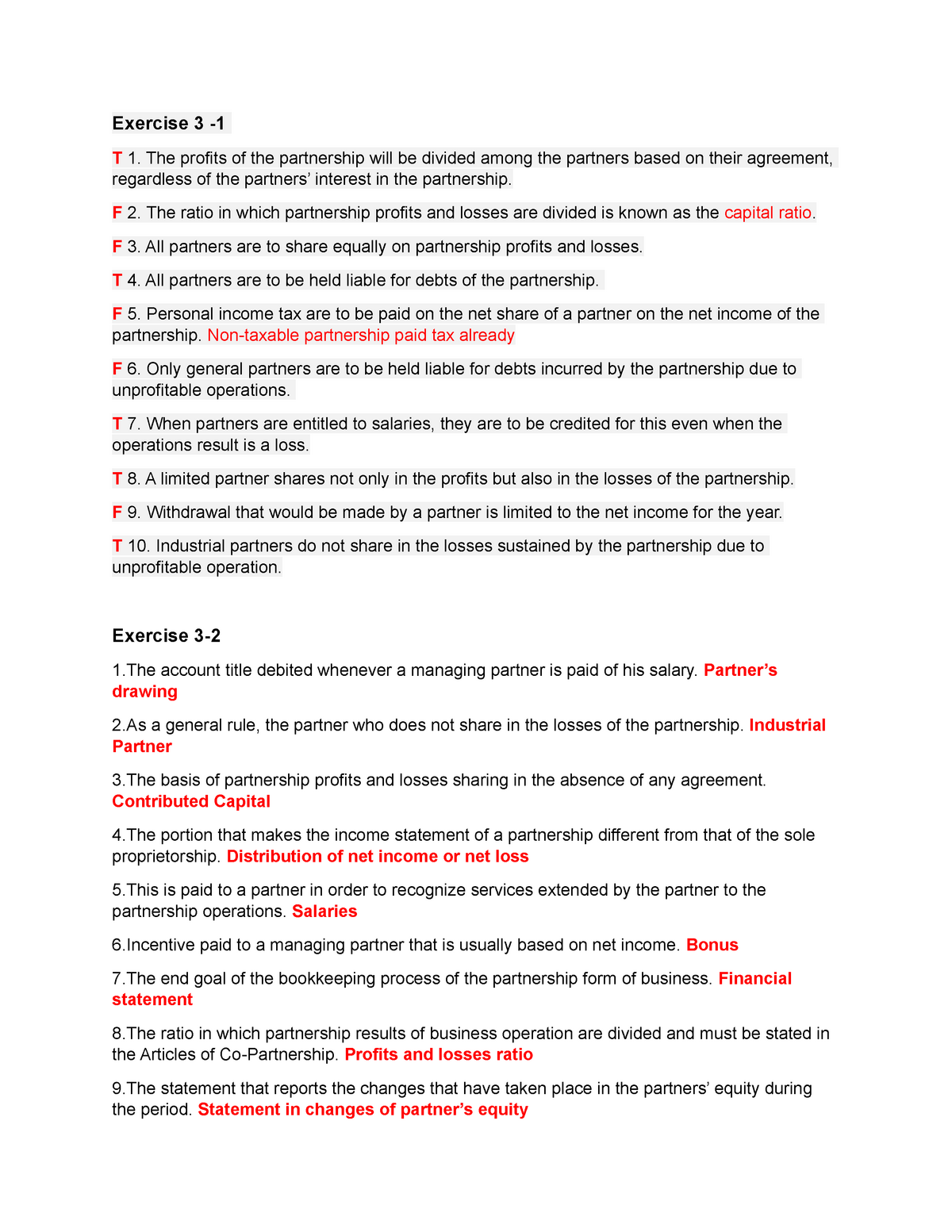

Exercise 3 1 3 4 Acc1 Exercise 3 T 1 The Profits Of The Partnership Will Be Divided Among The Studocu

What Is A Partnership Agreement Insights Alston Asquith

Digital Divide In The United States Wikipedia

Free Partnership Agreement Template Create A Partnership Agreement

4 Fundamental Of Savitri Commerce Classes

Pin On Ingles Infantil

Partnership Agreement Questions To Ask Iron Horse

Covid Economics Centre For Economic Policy Research

Dissolution Of Partnership Deed Uk Template Make Yours For Free

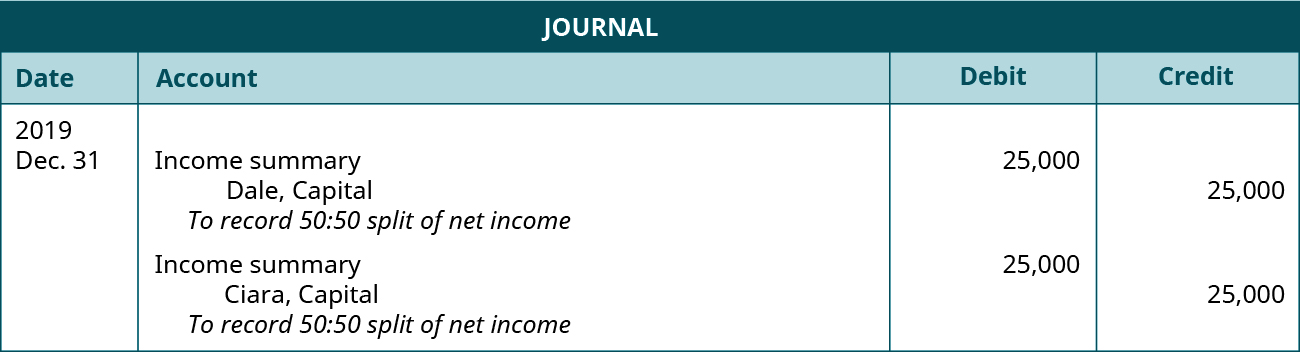

Compute And Allocate Partners Share Of Income And Loss Principles Of Accounting Volume 1 Financial Accounting

1

Distribution In The Absence Of Partnership Deed6 On 1st January 18 A And B Are Partners Brainly In

Partnership Operations Theories Accountancy Studocu

Phillysoc Org

Partnership Agreement Free Business Partnership Template Uk Lawdepot

Dk Goel Solutions Class 12 Accountancy Chapter 2 Accounting For Partnership Firms Fundamentals

How Business Partnership Structures Work In Law

Partnership Firm Types Deed Agreements In India Indiafilings

Ally My Journey Across The American Israeli Divide Oren Michael B Amazon Com Books

Partnership Profit Sharing Factors

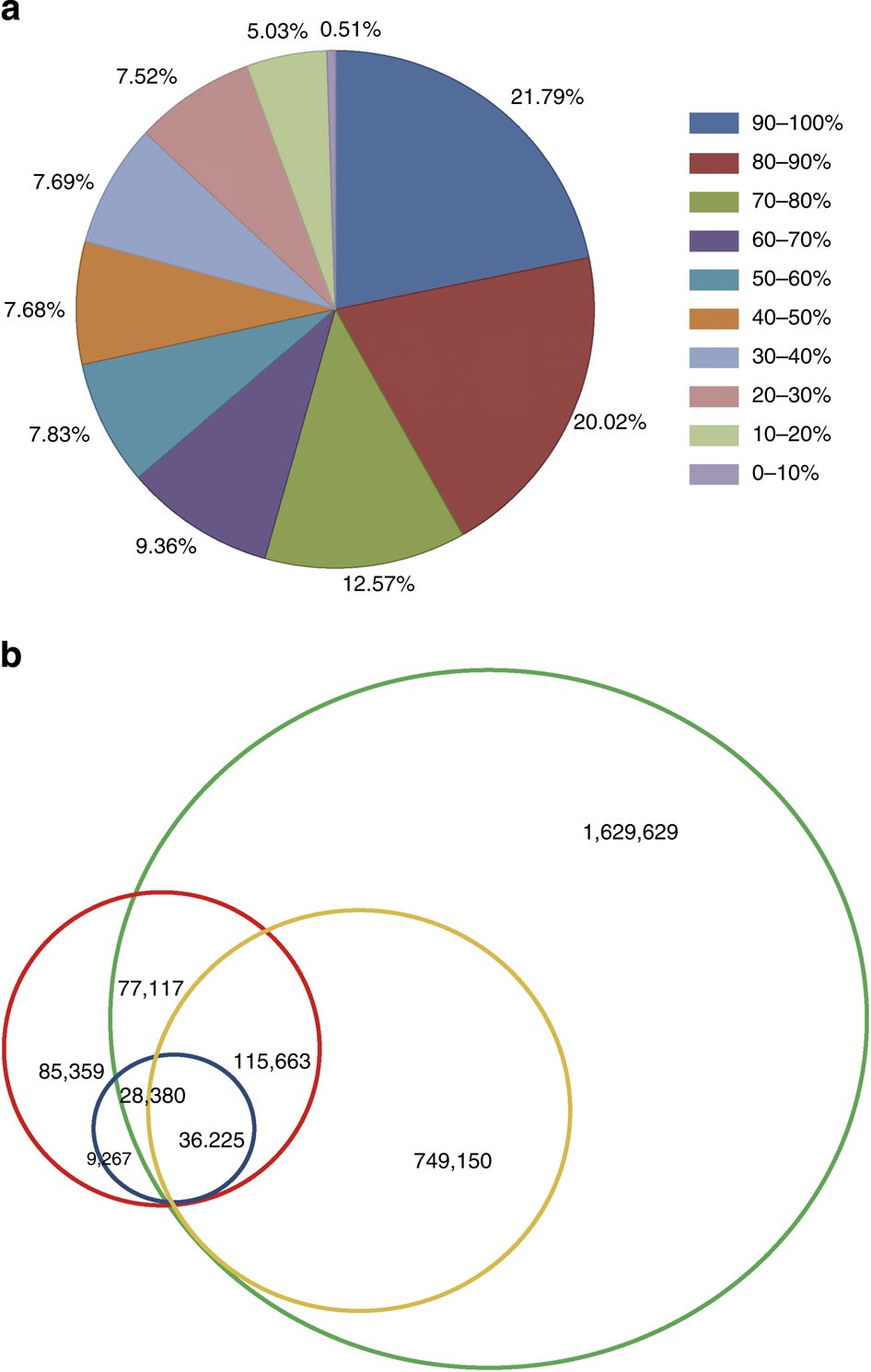

Rna Sequencing Reveals The Complex Regulatory Network In The Maize Kernel Nature Communications

A Divided America And The World Orf

2

Sbpsranchi Com

2jnomj8w4bzlom

Basic Concept Sole Proprietorship Business Forms Of Business Partnership Joint Hindu Family Business Cooperative Society Company Ppt Download

2

Divided We Fail Vaccine Diplomacy And Its Implications Heinrich Boll Stiftung Hong Kong Asia Global Dialogue

What Does Inter Se Mean With Picture

Partnership Deed Contents Features Benefits All You Must Know

Q1 In Absence Of Partnership Deed How Is The Profit Divided In Partners Cbse Class 12 Accounts Youtube

P 1 Ppt Powerpoint

In The Absence Of Any Partnership Agreement The Chegg Com

Rules Applicable In The Absence Of Partnership Deed Youtube

A1042advisorsvii

Week 6 Fundamentals Of Partnership Answers Pdf Partnership Corporations

Doc Law 2 Complete Manuel Bautista Academia Edu

In Absence Of Partnership Deed How Is Profit Divided Brainly In

Dk Goel Solutions Class 12 Chapter 2 Free Study Material

Solved 3 In The Absence Of A Partnership Agreement Rupa Chegg Com

Partnership Operations Pdf Partnership Income Statement

Distribution Of Profit In A Partnership Explanation Examples Finance Strategists

Free 8 Sample Business Partnership Agreement Forms In In Pdf Ms Word

2

2

The Consequences Of Not Having A Written Partnership Agre Wake Smith News

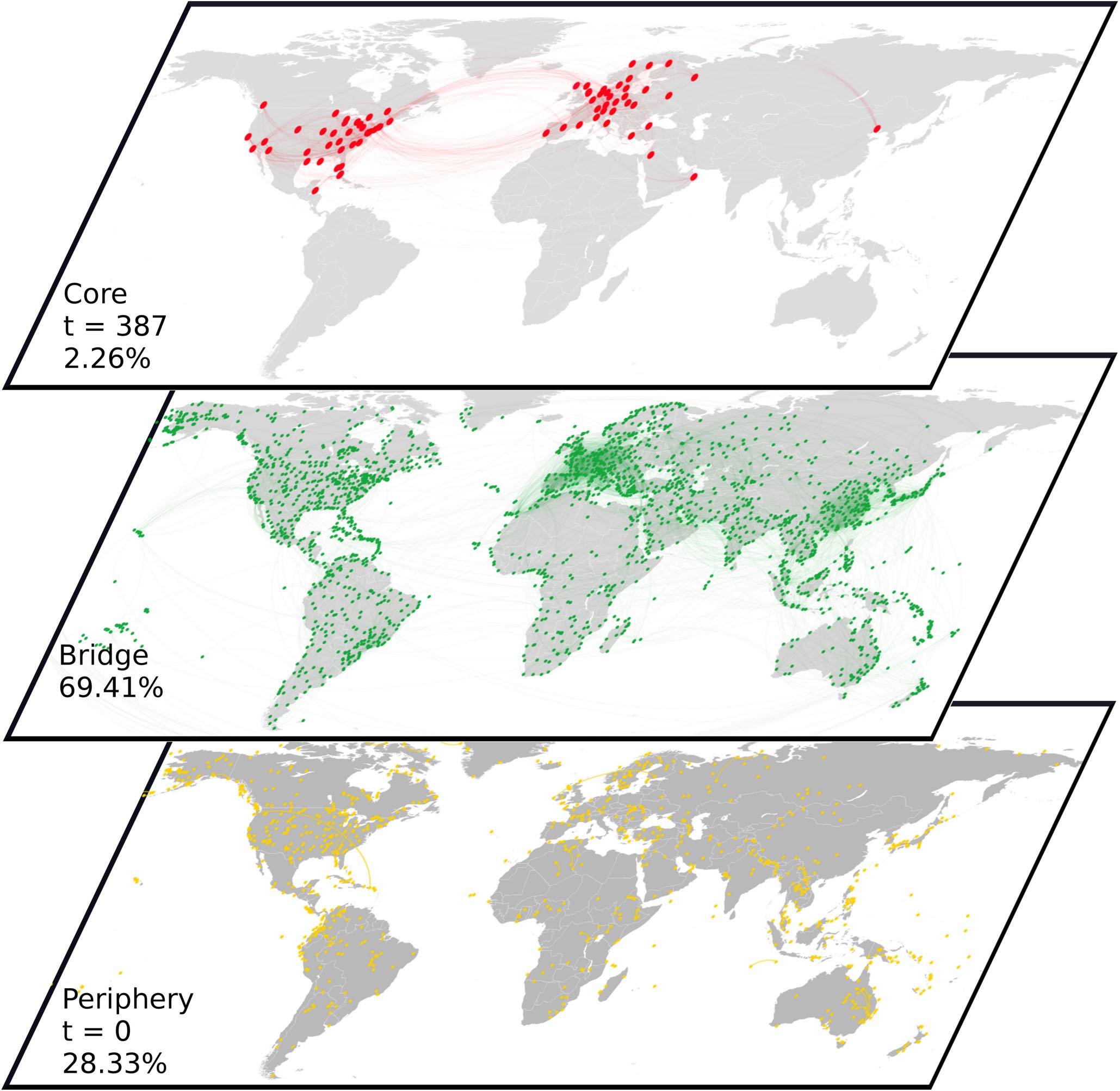

Revealing The Structure Of The World Airline Network Scientific Reports

Fundamentals Of Partnership Mcqs And Answer 12 Cbse Exam 22

Accounting For Partnerships Ppt Video Online Download

Partnership Definition Features Advantages Limitations

Page Date 1 The Absence M Which Noctio Partners Is Divided Of Partresship Deed In Which Ratio Profit Brainly In

Tm 4 S1 None 70 s

Partnership Act 10 Ralli Partnership Law

Partnership Deeds Meaning Contents With Solved Questions

Ts Grewal Solutions For Class 12 Accountancy Accounting For Partnership Firms Fundamentals Cbse Tuts

Bridging The Divide Autonomous Vehicles And The Automobile Industry Center For Strategic And International Studies

2

As Per The Commercial Companies Law Of Oman In The Chegg Com

Q1 In Absence Of Partnership Deed How Is The Profit Divided In Partners Cbse Class 12 Accounts Youtube

Free Partnership Agreement Template Create A Partnership Agreement

Omission Due To Absence Of Partnership Deed Accountancy Accounting For Partnership Basic Concepts Meritnation Com

Uu We Useliorantimp On 1st January 18 A And B Are Partners Employing Capital Of 1 00 000 And 1 000 Respectively On The Same Day A Gave A Loan To The Firm Of 45 000

1

Dpsbpkihsdharan Org

Mp Board Class 12th Accountancy Important Questions Chapter 2 Partnership Accounts Basic Concepts Mp Board Solutions

4 Types Of Business Organizations What To Choose Fast Capital 360

0 件のコメント:

コメントを投稿